Risky business

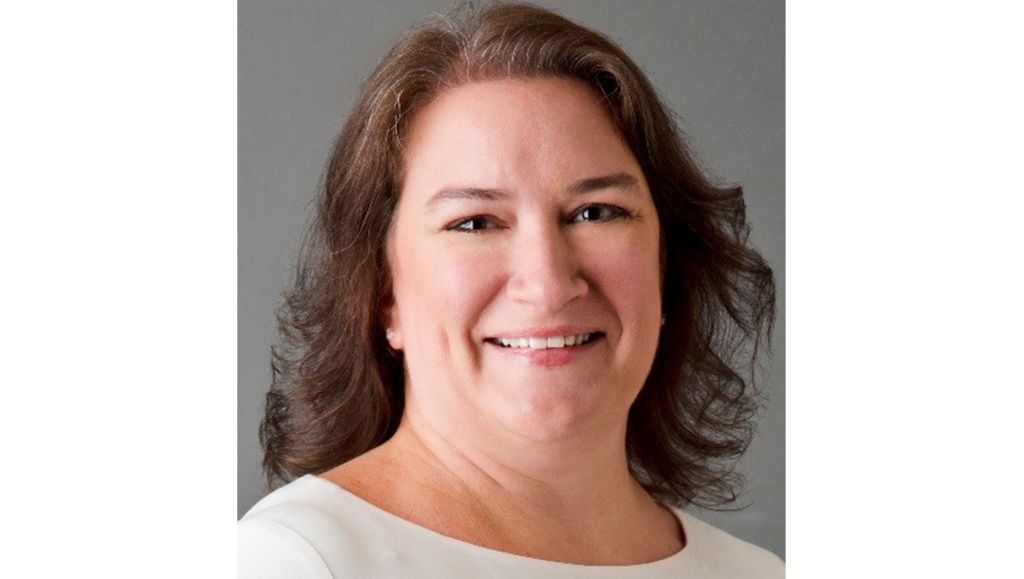

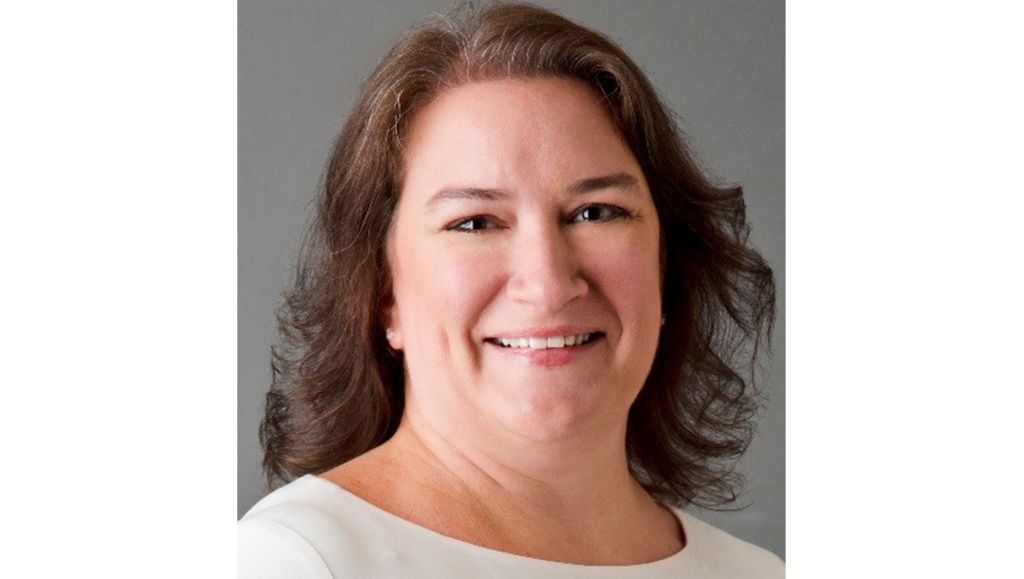

“Credit is like a puzzle,” says Renee Hiner, Vice President of Credit and Underwriting in the Global HQ of VFS. “Only you rarely get all the pieces. The trick is to work out what the whole picture looks like and where the risks in the deal are. We are right more than we are wrong, yet deals do go bad from time to time. If they didn’t then we’d probably be acting too conservatively – and if they went bad too often we’d be guilty of being overly aggressive in our lending. It’s my job to get the balance just right.”

After a decade running the Credit & Risk department for VFS Americas, Renee now does the job globally. Only the biggest deals come across her desk, and it’s Renee’s job to help everyone understand the risks involved. “The salesperson wants to do the deal – I get that and I do, too – but from a finance company perspective we have to be sure that the customer will pay back the loan over the whole term. It’s my job to be the devil’s advocate and look for trouble.”

Credit where it’s due

Renee, 52, was born in Pennsylvania and grew up in Richmond, Virginia. She was the tomboy middle child between two brothers. Their father was an architect and mother a chemist, and young Renee was expected to do well at school – which she did, along with being a gifted swimmer. By calling off plans to be a physical therapitst, then a chemist she decided to be an economist. The young Renee looked up to her father, who was always there to help his friends and family. But while Mr. Hiner was an extrovert, his daughter is a self-confessed introvert. Except when she’s talking about credit.

“I hate talking in public, but I love sharing with others the secrets that companies’ financial statements are telling us – that’s fun!” she laughs. Over her 22 years at VFS, Renee has taught countless sales people and credit analysts all over the world, and helped establish the company’s Credit Academy, which forms the basis of VFS’s credit culture.